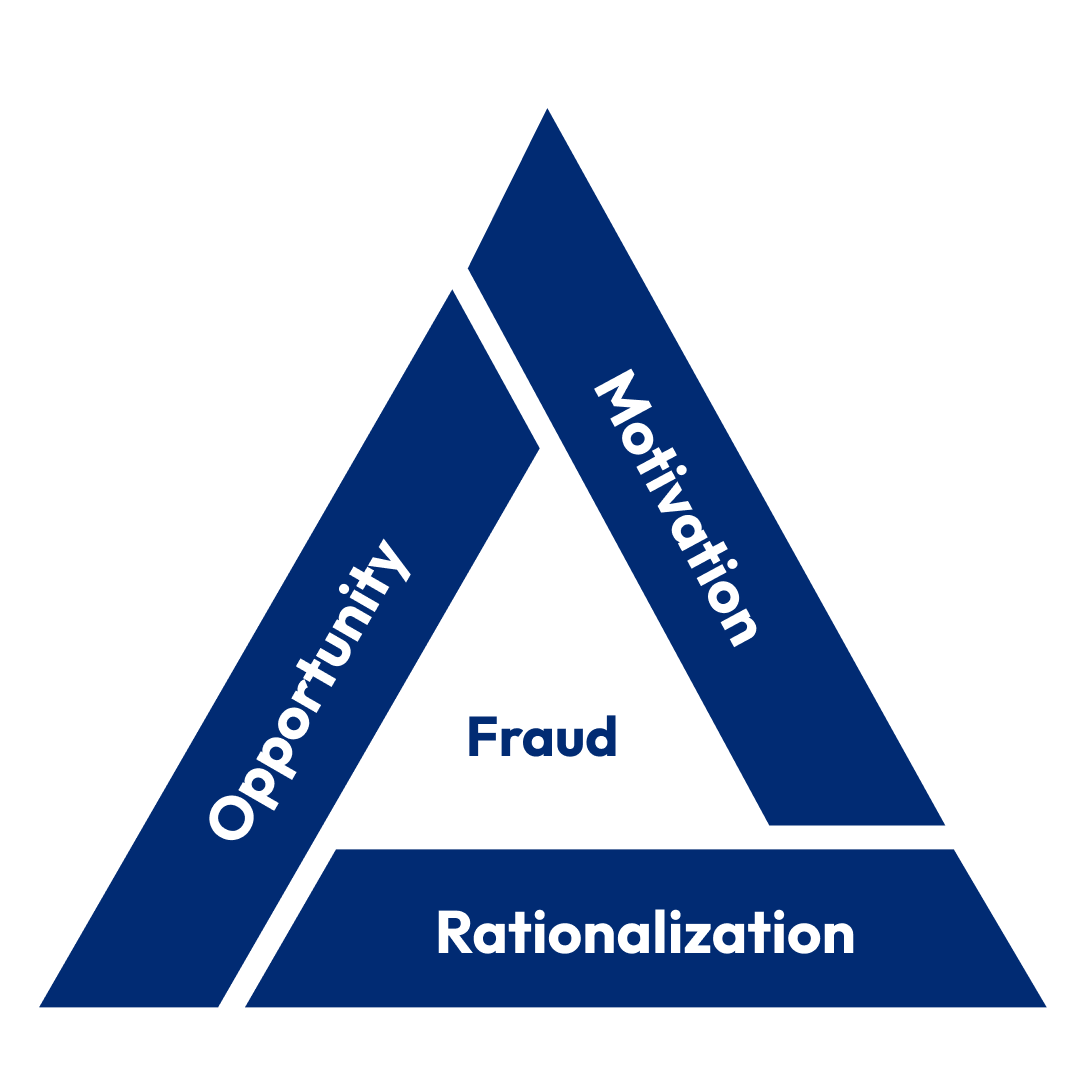

A healthcare group in the GCC faced inflated invoices

and duplicate billing from collusion between

internal

staff and vendors.

Our Approach

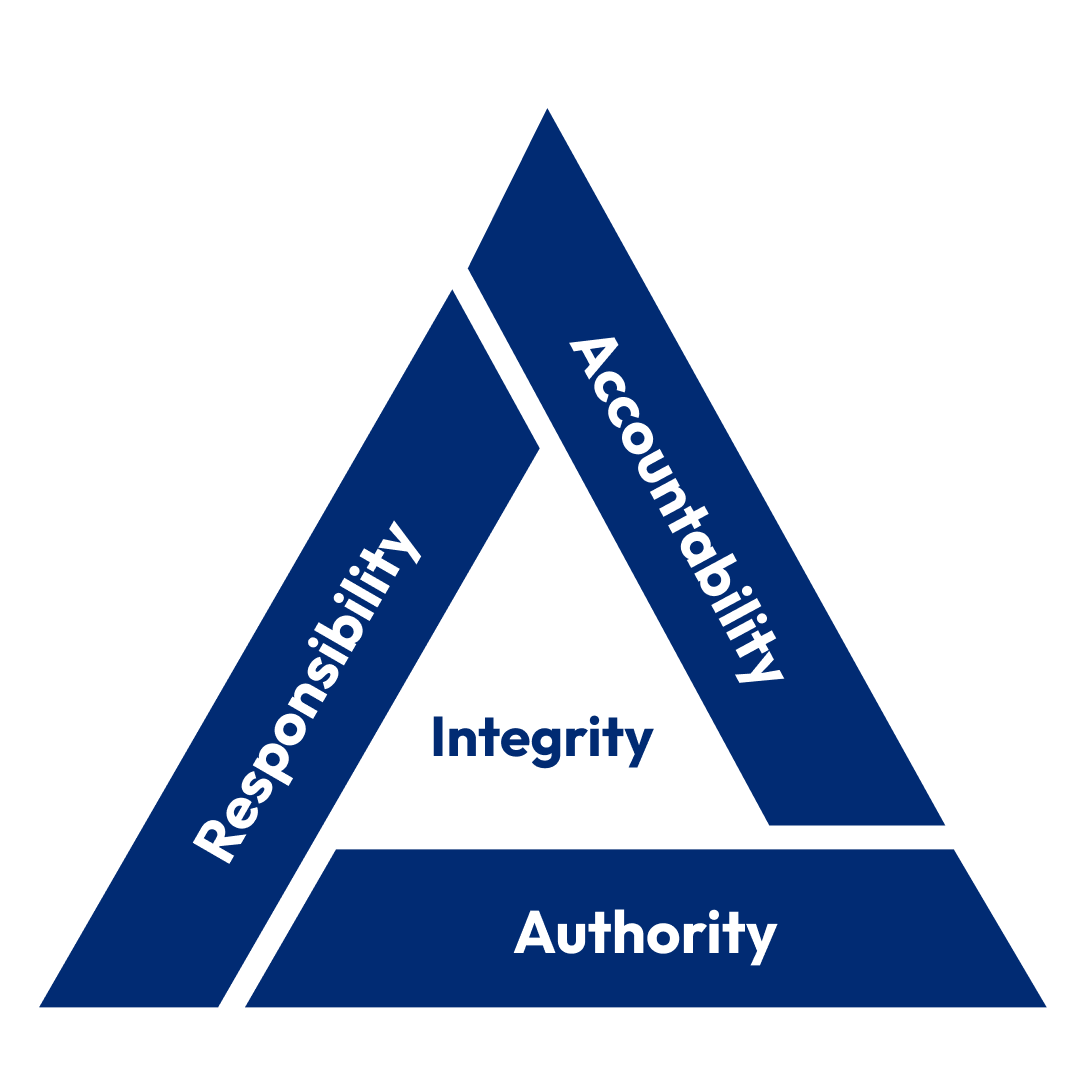

- We conducted forensic reviews of contracts and payments, uncovered collusion, and redesigned procurement controls.